Quick Summary

- Understand what “smart investing” means in 2025 and why diversification matters.

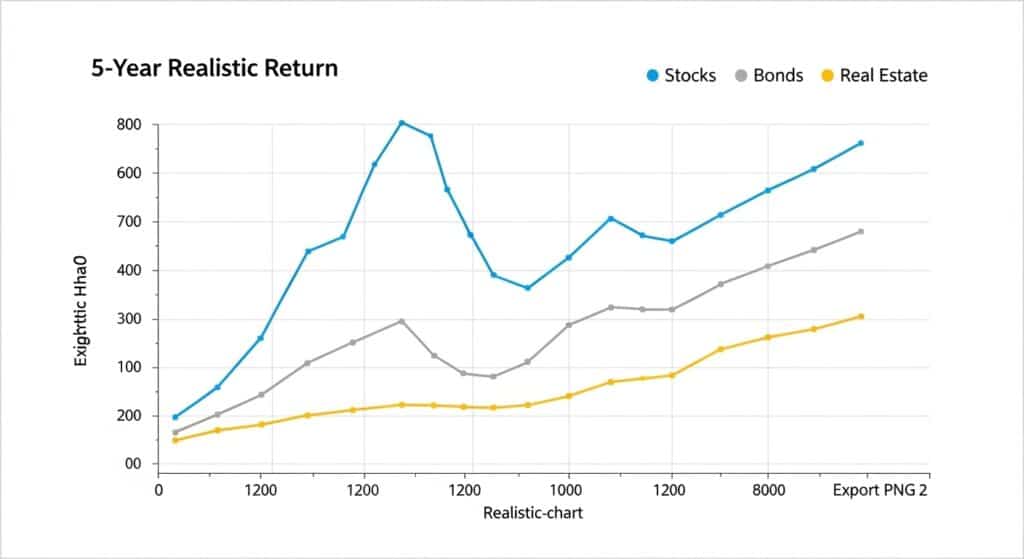

- Compare traditional investments (stocks, bonds, real estate) with modern options (crypto, AI-driven funds, digital businesses).

- Learn a step-by-step system to build a balanced portfolio, manage risk, and avoid common mistakes.

- Get recommended tools, checklists, and image prompts to illustrate the article.

Introduction

2025 is a year of transition and opportunity: macro uncertainty, faster AI adoption, and new asset classes (crypto maturing, tokenized assets, and income from digital businesses). Smart investing today is not about chasing trends — it’s about applying framework + discipline + modern tools to balance risk and return.

This guide teaches practical, actionable steps to create a resilient investment plan that blends time-tested strategies (stocks, bonds, real estate) with modern options (cryptocurrencies, AI-managed portfolios, digital assets). Wherever possible we cite authoritative data sources and recommend tools so you can act with confidence.

⚠️ Risk Notice: Nothing here is personalized financial advice. Investing involves risk, including loss of principal. Consult a licensed financial professional for tailored guidance.

What Does “Smart Investing” Mean in 2025?

Smart investing = intentional capital allocation aligned with goals, time horizon and risk tolerance, leveraging diversification and data-driven tools.

Key principles:

- Goal-first: define short-, medium-, long-term goals (retirement, home, business capital).

- Risk tolerance + capacity: emotional comfort vs. capacity to bear loss.

- Diversification: across asset classes, geographies, and strategies.

- Costs & taxes: minimize fees and plan for tax efficiency.

- Continuous learning and rebalancing.

Traditional Investment Options

Stocks (Equities)

Stocks represent ownership in companies. Long term, equities outperform most asset classes, but volatility is high. Use strategies:

- Core-satellite: core = low-cost index funds/ETFs; satellite = selective active bets.

- Dollar-cost averaging (DCA) reduces timing risk.

Practical tip: prefer broad ETFs (e.g., S&P 500, MSCI ACWI) for global exposure, and sector ETFs for tactical allocation.

Cite primary sources: historical returns — Vanguard/BlackRock research, S&P database.

Bonds & Fixed Income

Provide income and lower volatility. Types:

- Government bonds (Treasuries) — low risk.

- Corporate bonds — higher yield, credit risk.

- Inflation-protected (TIPS) — defense against inflation.

When to use: increase allocation in low-rate environments for income, reduce during rising-rate cycles.

Real Estate

Benefits: rental cash flow, inflation hedge, tangible asset. Consider REITs for liquidity and fractional real estate platforms for lower entry costs.

Drawbacks: transaction costs, leverage risks, illiquidity.

Modern Investment Options (Digital & Alternative)

Cryptocurrencies & Tokenized Assets

Crypto is volatile but increasingly institutionalized. Key considerations:

- Store of value vs. utility assets: Bitcoin vs. Ethereum/DeFi tokens.

- Security: hardware wallets, multisig, reputable exchanges.

- Regulatory risk: changing rules across jurisdictions.

Position sizing: small % of portfolio (depending on risk profile), and never money you can’t afford to lose.

AI-Driven Portfolios & Robo-Advisors

Robo-advisors (Betterment, Wealthfront) and AI platforms auto-manage rebalancing and tax-loss harvesting. They remove emotional bias and can be cost-effective.

Use case: beginners or busy investors seeking disciplined execution.

Digital Businesses & Online Income (as an “asset”)

Building websites, e-commerce stores, digital products (courses) generates cash flow—treated as an alternative low-correlated asset.

Advantage: potential for high returns and passive income when scaled; requires skills and operational work.

Other Alternatives

- Commodities (gold, silver) as portfolio diversifiers.

- Private equity, angel investing — high return potential, illiquid and high risk.

How to Build a Balanced Portfolio (Step-by-Step)

Step 1 — Define Goals & Time Horizons

- Short-term: <3 years — keep in cash or short-term bonds.

- Medium: 3–10 years — balanced mix (stocks + bonds + alternatives).

- Long-term: 10+ years — higher equity allocation.

Step 2 — Assess Risk Profile

Questionnaire (examples): age, dependents, income stability, investment experience, reaction to a 20% drawdown.

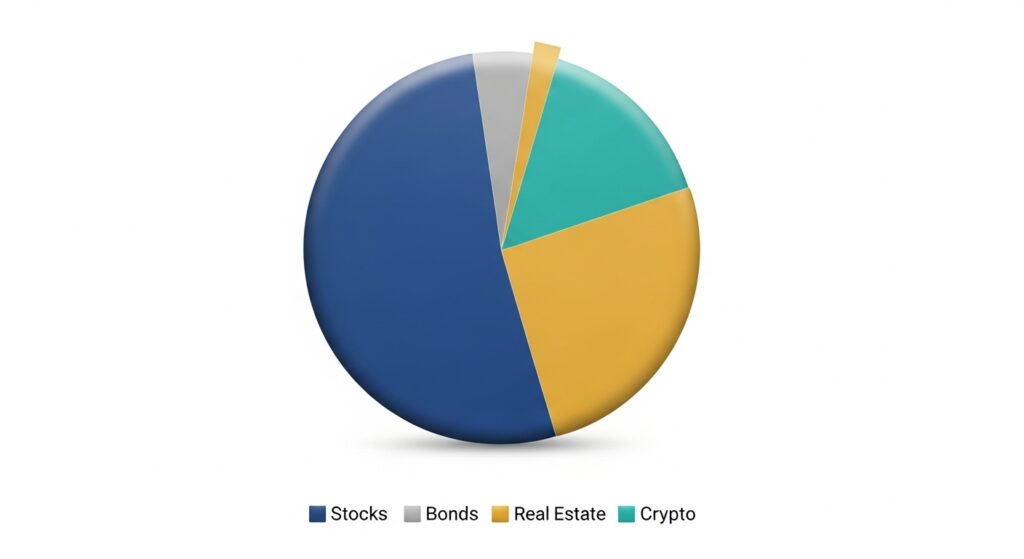

Step 3 — Asset Allocation Framework

Example conservative / moderate / aggressive splits:

- Conservative: 30% stocks / 50% bonds / 10% RE / 10% cash/alternatives.

- Moderate: 50% stocks / 30% bonds / 10% RE / 10% alternatives.

- Aggressive: 70% stocks / 10% bonds / 10% crypto / 10% alternatives.

Step 4 — Choose Vehicles (ETFs, direct stocks, REITs, crypto spot, funds)

Prefer low-cost ETFs for the core; satellites via active funds or direct positions.

Step 5 — Rebalance & Tax Efficiency

Rebalance annually or when allocations deviate >5–7%. Use tax-advantaged accounts where available (IRAs, 401(k) equivalents) and consider tax-loss harvesting.

Risk Management & Preservation

- Emergency fund (3–6 months expenses) separate from investments.

- Position sizing: no single asset should risk >2–5% of portfolio value.

- Stop-loss or mental stop: plan exits ahead of time.

- Hedging: options for sophisticated investors, or gold/treasuries as natural hedges.

- Security hygiene for digital assets**: hardware wallets, cold storage, 2FA, never reuse passwords.**

Common Mistakes & How to Avoid Them

- Chasing hot tips → due diligence checklist: motive, data, financials, liquidity.

- Overtrading → costs and taxes eat returns. Use a plan and stick to it.

- Ignoring fees → high MERs or platform fees drastically reduce long-term returns.

- No diversification → concentration leads to idiosyncratic risk.

- Neglecting behavioral biases → loss aversion, herd behavior. Use automatic contributions and rules.

Case Studies & Practical Examples

Case Study A — Conservative Retiree Portfolio (Age 60)

Allocation: 40% bonds, 35% dividend stocks/ETFs, 15% REITs, 10% cash. Result: predictable income, lower drawdown, prioritizes capital preservation.

Case Study B — Young Aggressive Investor (Age 28)

Allocation: 60% global equities, 15% small-cap/sector ETFs, 10% crypto, 10% digital business reinvestment, 5% cash. Result: high growth potential, tolerates volatility.

(Include charts—see image prompts below.)

Tools & Resources (Recommended)

- Market data & charts: TradingView, Bloomberg (paid).

- Portfolio trackers: Personal Capital, Kubera.

- Education: Investopedia, Coursera finance courses, CFA Institute articles.

- Robo-advisors: Betterment, Wealthsimple.

- Security (crypto): Ledger, Trezor, multisig services.

Conclusion

Smart investing in 2025 blends classic financial principles with modern tools. The steps are simple in concept — define goals, diversify, control costs, manage risk — but execution requires discipline and continuous learning. Use low-cost index funds as portfolio anchors, complement them with selective modern assets (crypto, digital business) sized to your risk tolerance, and leverage AI tools for disciplined execution where appropriate.

Start small, prioritize an emergency fund, and automate monthly investments. Over time, compound returns and consistent strategy beat speculation.

Call to action: Subscribe to TheGoldNine newsletter for monthly investment playbooks and exclusive templates to build and track your portfolio.

Author Box (E-E-A-T)

Ernaldo Efigénio — Founder & Financial Content Creator

Entrepreneur with 6+ years in sales, experience in XAUUSD trading, marketplace growth, and digital monetization. Writes practical guides combining market analysis and applied financial strategies. LinkedIn: [add-link] — Contact: support@thegoldnine.com.

Last reviewed: October 16, 2025.

Disclaimer & Risk Warning

This article is for educational purposes only and does not constitute financial advice. Investing involves risk of loss. Consult a licensed financial advisor before making decisions.